Commercial Auto Insurance in British Columbia

What is commercial car insurance and why do you need it

Whether you have one single delivery van, a fleet of heavy-duty trucks, or a massive garage operation, you deserve customized commercial auto insurance that meets the needs of your business. As one of Canada’s largest commercial auto insurance providers in Surrey, our brokers can help you choose the right amount of coverage. From accidental property damage to workplace injuries, our brokers will select the right level of liability coverage to protect your BC business.

We stand by our core values of professionalism and integrity and are committed to continuously improving the quality of the service we provide you. Unsure of the type of commercial auto insurance policy you need? Work with an insurance broker that will not only make the experience informative and simple but can get you the best price for your appropriate coverage.

When it comes to commercial vehicle insurance, we have your options covered. At Goldleaf, we believe your focus should be on your business, not your insurance coverage. So, whether you need liability coverage, comprehensive coverage, collision insurance, or any other form of additional coverage, our team is here to do the work, so you don’t have to. Insure your vehicle(s) with Goldleaf, and we can provide prime protection for your employees, your business, and yourself.

What are the different types of commercial vehicle insurance

No matter what kind of wheels your business depends on, we’ve got the coverage to protect them. Any type of vehicle – including cars, trucks, vans, commercial trailers, and more – can be used for business purposes. Be sure to discuss commercial auto insurance with our brokers if you:

- Use a personal vehicle to transport business equipment

- Provide delivery services

- Are a rideshare contractor

- Run a commercial fleet

- Spend a significant amount of time driving to meet clients

- Use your vehicle(s) for any other purpose related to your business

What Does Commercial Auto Insurance Cover

From one or multiple cars to large fleets and heavy-duty trucks, our selection of commercial auto insurance plans protect all types of businesses. Some popular insurance plans include:

- Commercial Fleet Policy. If your business has more than 20 eligible vehicles, you can save time, money, and administrative stress with our commercial fleet policy.

- Non-Fleet Commercial Vehicles. Running a commercial delivery business with less than 20 vehicles? Protect your assets with our affordable non-fleet plan.

- Fleet or Business Vehicle Drivers. In the past, drivers involved in at-fault collisions while using their employer’s vehicle would have limited their access to insurance policies. But not anymore! Ask about our driver liability insurance to protect your business and staff.

- Garage Service Operations. Need commercial auto insurance to protect your lot, repair shop, or tow yard? We’ve got the coverage plans for you.

- Ride-Hailing Services. Whether it’s Uber, Lyft, or another type of ride-hailing service, we offer several types of insurance plans to ensure your peace of mind and protection.

- Peer-to-Peer Vehicle Rental. Want to rent your car out for a little extra income? Before making your vehicle available via online rental platforms, ask about which insurance plan will provide the coverage you need.

If you’re interested in finding out what regular auto insurance covers in BC, go ahead and read on our website.

Commercial Fleet Coverage Options

Standard Coverage

Third-Party Liability

Third-party liability coverage protects your company and drivers should you be responsible for damaging third-party motor vehicles or someone’s property.

Direct Compensation Property Damage (DCPD)

In the event of an accident, this type of fleet insurance coverage protects your business when your driver is partially or not at fault. This plan protects your commercial fleet vehicles, what’s in it (e.g., cargo), and the damages for loss of use. Rather than suing the at-fault driver, you can go directly through your insurance broker.

Accident Benefits

Have you or any employees been injured in an accident? Regardless of who is at fault, accident benefits can provide you with financial assistance while you recover.

Optional Coverage

Collision or Upset

This plan includes collision coverage to protect against damages done to your commercial automobile should it flip over or collide with a third-party vehicle and/or object.

Comprehensive Coverage

Comprehensive fleet policies cover your vehicle for damages outside of collision or upset. For example, vandalism, fire, flood, theft, hail, etc.

All-Perils

All-perils, also known as “all-risk,” combines the benefits of comprehensive coverage and collision or upset. But it also protects your company’s fleet from theft conducted by an employee who drives, uses, or services your company vehicles.

Specific Perils

Specific perils covers the losses caused by damages specified in your policy. For example, fire, theft, lightening, etc.

All-Perils Excluding Collision or Upset

This protects companies from damages outside of collision or upset, such as fire, vandalism, hail, theft, flood, and more.

Enhanced Coverage

Good Record Guarantee

Good record guarantee provides a means of tracking and verifying the safety and compliance of your business’s fleet operations, while also protecting against potential liability and financial losses. It ensures that your insurance premiums won’t increase at time of renewal should you suffer two or less losses over a 5-year period.

Responsible Driver Protection

Responsible driver protection ensures the cost of your insurance premium will not increase at renewal following your first chargeable at-fault incident.

Roadside Assistance

Insure your business and operate your fleets with confidence under the protection of roadside assistance. This extension entitles businesses to four service calls per year for each covered commercial vehicle weighing 4,500 kg or less. This includes:

- Battery boosting

- Tire changes

- Towing for distances of 50 km or less

- Fuel delivery

- Door unlocking

- Winching

Vehicle Replacement

If your commercial vehicle was stolen or damaged beyond repair, this plan will cover the cost of replacement. You will receive compensation for the vehicle’s original value rather than the depreciated value post-accident.

Gain Peace of Mind with Fleet Insurance

Protect your commercial fleet in British Columbia with the help of Goldleaf Insurance. Whether you have trucks, trailers, or company cars, our team can save you money and protect your business from the unexpected. Contact one of our Goldleaf fleet insurance BC brokers today to get started.

How Much Does Commercial Auto Insurance Cost in BC

At Goldleaf Insurance, we pride ourselves on offering customizable, stress-free, and affordable commercial auto insurance to our customers. Depending on the level of coverage your business needs, the cost of insurance will vary. For a quote on the insurance plan best suited for your commercial vehicle(s), our team is here to advise.

Best Way to Get a Commercial Auto Insurance Policy in Surrey

Whether your operation has one vehicle or many, you need commercial auto insurance coverage to protect your company vehicles. In British Columbia, valid commercial insurance is required to operate any vehicle on a road or highway. Whether it’s a company vehicle, trailer, truck, single utility van, or fleet, your commercial auto policy can be tailored to fit the unique specificities of your business. How can you learn your insurance options to protect your assets? We recommend speaking with a Goldleaf insurer directly to learn your business insurance options. Here is what you can expect…

At Goldleaf Auto Insurance in Surrey, we are committed to providing you with financial security. Before you buy business insurance, it is crucial you understand your options to determine the right coverage. As our client, you will be assigned a personalized broker who is familiar with the nuances of your case. Your assigned agent will meet with you to learn your needs, budget, expectations, and lifestyle. Together, you will discuss details such as collision coverage, third party liability, property damage, bodily injury, perils coverage, and all other factors affecting your business insurance policy. This comprehensive discussion will ensure your commercial auto policy has the right features to keep you and your business protected.

To guarantee that you, your employees, and your businesses have the protection they need, let Goldleaf Insurance be your safety net. We are not just here to help you mitigate risk and cut costs with your commercial insurance policy. We are also here to support you long-term as your business grows and your commercial vehicle insurance needs change. Day or night, you can rely on our team at Goldleaf.

Goldleaf Insurance

Address: 13049 76 Ave #102, Surrey, BC V3W 2V7

Phone: (604) 591 6200

Email: info@goldleafinsurance.ca

Open hours:

Monday – Friday: 9 a.m. — 11 p.m.

Saturday: 9 a.m. — 10 p.m.

Sunday: 9 a.m. — 9 p.m.

FAQ

What Classifies a Vehicle as Commercial Auto?

Your vehicle is classified as commercial auto when used for:

- Business purposes, including vehicles registered for commercial use or that have a commercial license plate or tag

- Public use, including those registered as a school or public bus

- Ride-hailing services, including taxi, Uber, Lyft, etc.

- Driver training

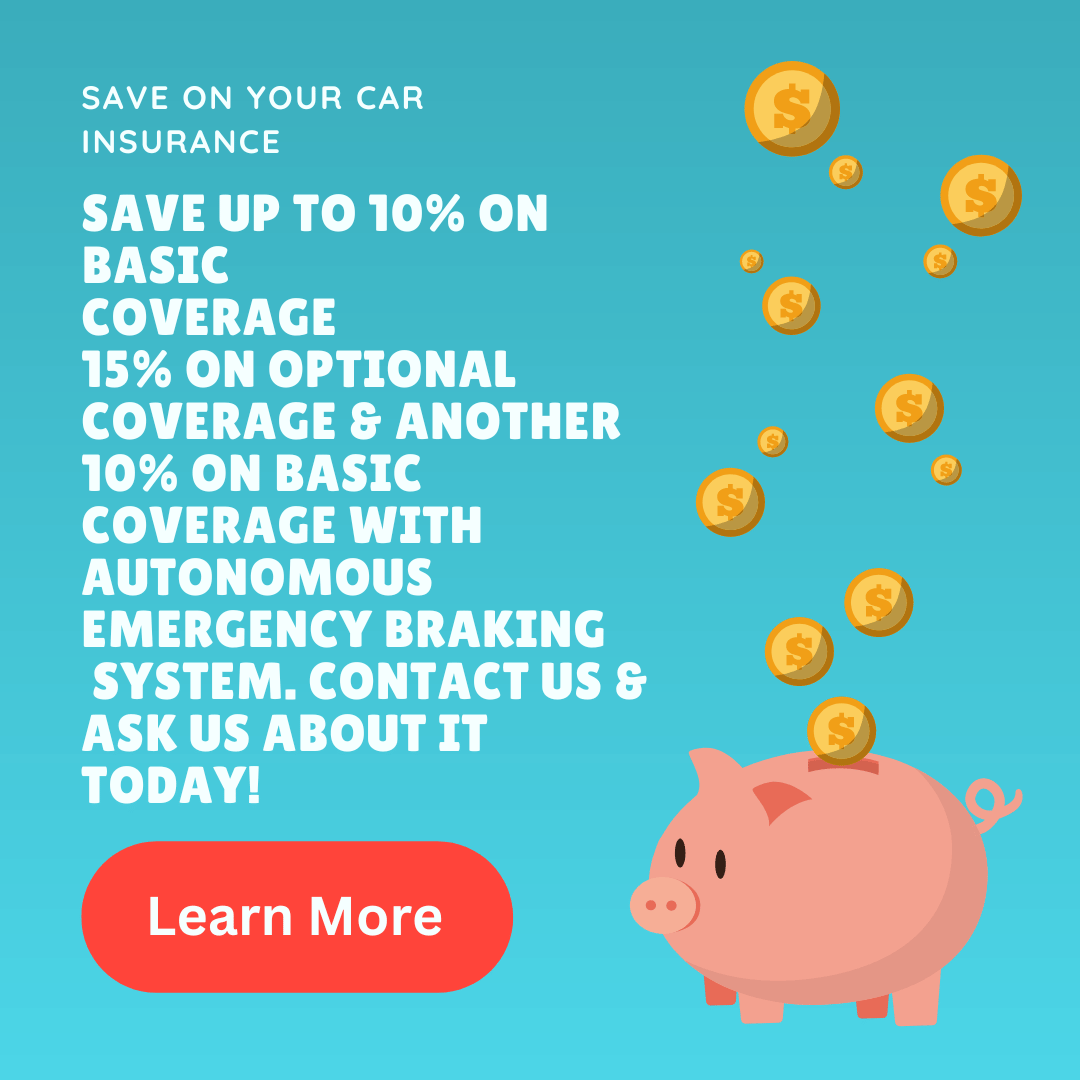

How Can I Save Money on Commercial Auto Insurance?

There are several ways you can minimize the cost of your commercial auto insurance. Depending on where you drive, the distance you travel, the number of commercial vehicles your business uses, etc. there are various discounts available. As one of Canada’s largest commercial insurance providers, we know how to help you save money with your plan. Just ask one of our brokers!

Do I Need to Apply for Fleet Status?

If your business uses between 5 to 19 vehicles, you can choose whether or not you want to apply for fleet status. However, if your business uses 20 or more vehicles for commercial or business use, then fleet status is required.

Can I use a commercial vehicle for personal use?

While commercial auto insurance protects vehicles intended for business and commercial use, personal use is also permitted. If your vehicle is going have various uses, speak to our brokers about the right level of coverage for you.